Debt Consolidation Loan Singapore: Discover the Best Solutions for Your Requirements

Debt Consolidation Loan Singapore: Discover the Best Solutions for Your Requirements

Blog Article

Exploring the Benefits of a Financial Debt Combination Car Loan: A Comprehensive Guide for Managing Numerous Financial Debts

Browsing the complexities of multiple debts can be a difficult task, frequently leading to complication and economic stress. A debt consolidation lending offers a critical service by combining numerous commitments right into a single, workable payment. This method not just streamlines one's economic landscape yet likewise offers prospective benefits such as reduced rate of interest and enhanced cash money circulation. However, recognizing the nuances of this economic tool is important for effective execution. When reviewing the suitability of a financial debt combination loan?, what aspects should one consider.

Recognizing Financial Obligation Debt Consolidation Loans

Understanding financial obligation combination car loans includes recognizing their fundamental objective: to streamline several financial obligations right into a single, manageable repayment. consolidation loan singapore. This monetary tool is designed to assist individuals who are overwhelmed by various financial debts-- such as bank card balances, personal loans, and clinical expenses-- by settling them right into one funding with a fixed rate of interest and term

Normally, a borrower obtains a brand-new lending to settle existing financial debts, thereby streamlining their monetary landscape. This procedure not just lowers the variety of month-to-month settlements however can likewise offer a clearer path to monetary security. Oftentimes, borrowers may locate that the new finance uses a lower interest rate than their previous financial debts, which can cause substantial cost savings in time.

Secret Advantages of Financial Debt Consolidation

Among the key benefits of financial debt consolidation is the possibility for minimized rate of interest, which can result in significant cost savings with time. By combining numerous high-interest financial debts into a single funding with a reduced passion rate, consumers can lower the total cost of their debt and improve their economic circumstance. This structured technique not only simplifies regular monthly repayments yet likewise reduces the risk of missed settlements, which can adversely impact credit report.

An additional trick benefit is improved capital. With a solitary monthly payment, debtors can much better manage their finances, enabling them to designate funds toward other crucial expenses or financial savings. In addition, financial obligation loan consolidation can provide an organized repayment strategy that assists individuals settle their financial debt much more effectively.

Additionally, financial obligation loan consolidation can minimize the stress and anxiety connected with handling several lenders, as it settles interaction and payment procedures into one convenient entity. consolidation loan singapore. This can foster a sense of control and assist in better financial preparation. Ultimately, debt combination supplies a path towards achieving monetary security, making it an attractive alternative for those looking for to restore their footing in the face of frustrating debt

Just How to Receive a Lending

Qualifying for a financial debt consolidation financing includes conference details criteria set by lenders to make certain consumers can pay back the obtained amount. The initial crucial factor is credit history; most lending institutions choose a rating of at least 650, as this indicates a reliable settlement history. Additionally, a reduced debt-to-income ratio is important; preferably, your regular monthly debt repayments ought to not surpass 36% of your gross regular monthly earnings.

Lenders additionally analyze your work background. A steady work with a constant earnings shows your capacity to handle continuous payments. Furthermore, offering documentation, such as pay stubs, income tax return, and financial institution statements, is usually required to validate income and expenses.

Contrasting Financial Obligation Consolidation Choices

After establishing the standards for qualifying for a financial obligation combination loan, it comes to be important to evaluate the various alternatives offered. Financial obligation combination can take numerous forms, each with distinctive features, benefits, and downsides. The main choices include individual financings, equilibrium transfer charge card, home equity lendings, and financial debt administration plans.

Individual fundings are commonly unprotected and can provide set rate of interest, making them an uncomplicated option for consolidating debts. Nevertheless, they may have higher rates of interest contrasted to safeguarded choices. Equilibrium transfer debt cards allow you to transfer existing charge card equilibriums to a new card, often with a low or no introductory rate of interest. While this can reduce passion, it needs persistent payment to avoid high prices as soon as reference the advertising period ends.

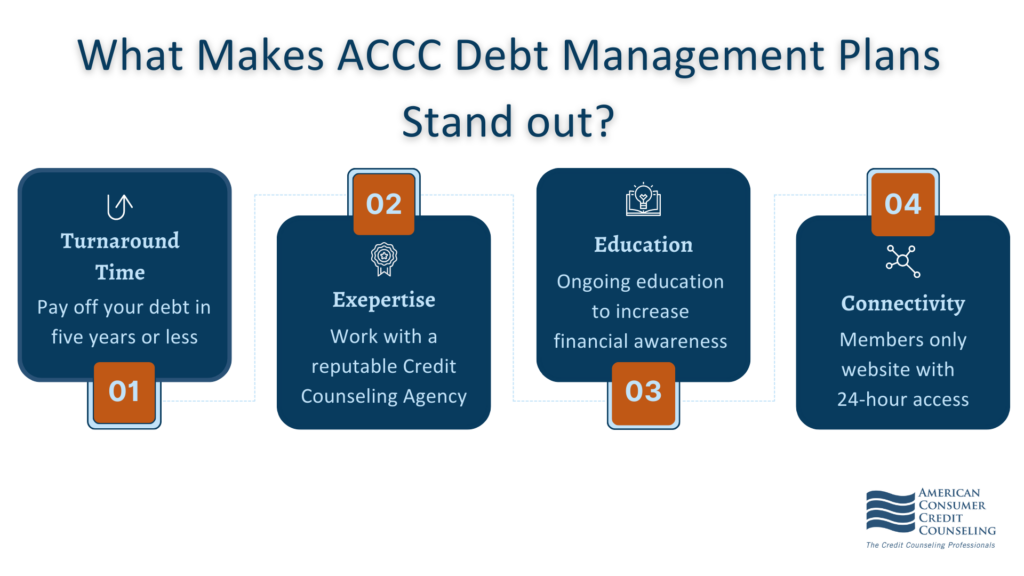

Home equity lendings utilize your home as security, usually supplying reduced rate of interest. Nevertheless, this choice brings risks, such as potential repossession. Lastly, financial debt administration plans involve dealing with a credit counseling company to discuss lower rates of interest with creditors and create a structured payment plan, though they may call for costs.

Very carefully weighing these alternatives versus your monetary situation will help in picking one of the most advantageous route for financial obligation loan consolidation.

Tips for Successful Debt Management

Following, prioritize your financial debts. Concentrate on paying off high-interest debts first while maintaining minimum repayments on others. This approach, commonly described as the avalanche technique, can save you cash over time. Conversely, consider the snowball technique, which emphasizes repaying the smallest financial debts initially to build energy.

Developing a reserve is also vital. Having cost savings to cover unanticipated costs avoids you from accruing additional debt when emergency situations arise. In addition, on a regular basis evaluating your economic situation can help you stay on track and adjust your strategies as needed.

Last but not least, communicate with your financial institutions. Some might supply assistance or different settlement strategies if you are struggling to meet payments. By embracing these methods, you can efficiently manage your financial obligations and job toward achieving an extra safe and secure financial future.

Conclusion

In final thought, financial obligation loan consolidation lendings use a critical solution for individuals i was reading this seeking to manage multiple financial obligations effectively. A well-implemented debt consolidation strategy ultimately serves as a pathway toward achieving monetary security and advancing toward a debt-free future.

Financial obligation loan consolidation loans can be safeguarded or unprotected, with guaranteed lendings requiring security, such as a home or automobile, while unsafe fundings do not (consolidation loan singapore). By consolidating multiple high-interest debts right into a solitary finance with a reduced passion price, debtors can decrease the overall expense of their financial debt and improve their financial situation. Additionally, debt combination can give an organized repayment plan that helps individuals pay off their financial obligation extra efficiently

Ultimately, debt combination uses a pathway towards accomplishing economic stability, making it an enticing alternative for those seeking to reclaim their footing in the face of overwhelming debt.

In verdict, financial obligation combination lendings provide a strategic click to read more remedy for individuals looking for to manage multiple financial debts successfully.

Report this page